Recap

Last week, we explained the steps involved in securitization process from which tokenization has emerged using the example of a real estate property owner pooling their ownership in rental properties.

Thus, there is an asset or a pool of assets which are consolidated & transferred to another entity to manage that pool.

Then, securities are issued against that pool of assets which is then sold to investors who earn return on those securities on the cash flows generated from the underlying pool

The below visual summarizes the securitization process:

Before we get into tokenization process, let us refresh on the requirements to initiate tokenization:

A Blockchain - the infrastructure in which tokens are stored

A Reference Asset - with a mechanism to derive & assess the value of such an asset

Custody - Means to provide custody for the Reference Asset

Settlement - Redemption & settlement of the Token & Reference Asset

Let us elaborate each of them below:

Tokenization Requirements

Blockchain

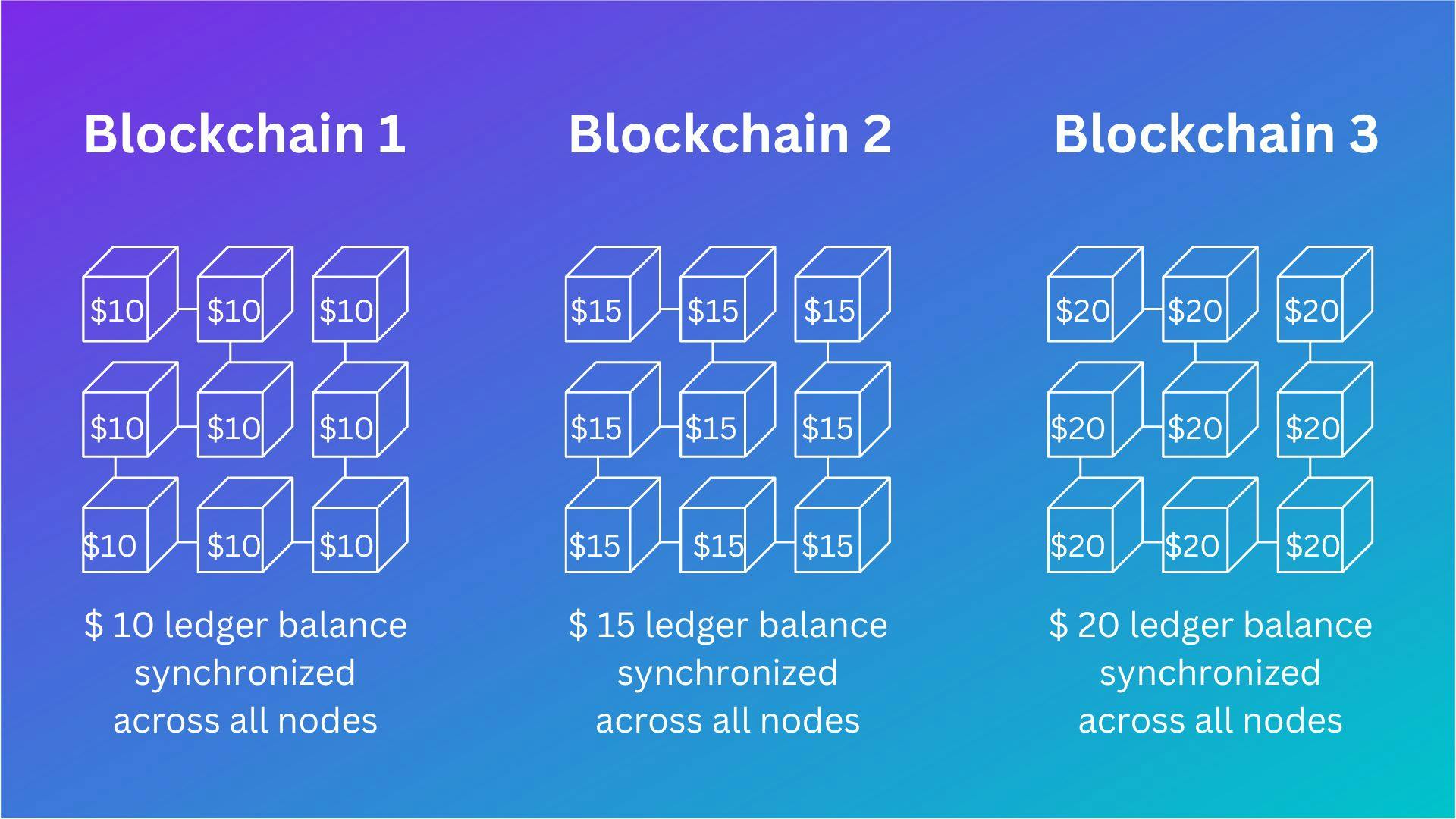

Blockchain is a decentralized ledger distributed across nodes connected through the internet which facilitates transactions & transfer value. Transactions are maintained in blocks which are connected through transaction references stored in block headers.

Each node maintains it's copy of the ledger which are synchronized across the entire Blockchain. This means all the nodes would show the same balance & transactions at a particular point in time. The below visualization shows three Blockchains with balances of $ 10, $ 15 & $ 20 synchronized across all nodes.

Blockchains can be

Public & Permissionless

Private & Restricted

A Combination of the above

The tokens are issued on a Blockchain where they are recorded & can be transacted. These tokens can be accessed through wallets which are linked to these tokens & can keep track of their balances & transactions.

The beauty of Blockchain is that these tokens can be accessed from anywhere in the world without any intermediaries or agents in between. This means access to such assets can be democratized & accessible by anyone interested through such tokens issued on the Blockchain.

Reference Asset

A Reference asset can be anything from Real Estate property, commodities, Intellectual Property, work of art etc which is subject to tokenization as the owners of the asset(s) have identified some monetization opportunities from that asset(s) & investment opportunities can be provided through tokenization to a wider range of investors which would not have been possible in traditional financial markets.

The asset(s) has to be identified separately for tokenization so that the token holders know which asset(s) are tokenized & used for the purpose of creating those tokens. This helps in linking the reference asset to the issued tokens.

It is just like a company's share which are issued by a particular company & denotes ownership of that company only. For example, a holder of Apple share owns a portion of Apple & not Microsoft.

In a similar vein, a token can only refer that particular asset(s) on account of which the tokens are issued. These tokens can only be used in reference to that asset(s) only & no other asset(s). There is a legal binding between the tokens & the reference asset(s) in that the token holders get access to the returns (cash flow) or services from those asset(s).

Reference Asset Custody

The reference asset needs to be identified as specified above on tokenization & placed in custody with a registered custodian. Why?

That is because investors or token holders pay funds to the token issuer for the required services. Hence to ensure the interests of token holders are protected & they are safeguarded from fraud or similar activities, the asset(s) will be placed with a custodian who ensures security & safe custody of the asset from falsification or tampering, in other words ensuring integrity of the asset(s).

A custodian safeguards & verifies the asset(s)' connection to the tokens on the Blockchain. Appointing a trusted & reliable custodian is crucial for maintaining the integrity & security of the tokenized asset.

Redemption & Settlement

At the end of the token period, the tokens need to be redeemed & the token holders paid. This can be done by paying off the token holders from the token issuer's funds or by selling the reference asset.

This process must be conducted in line with applicable laws & regulations. It should be ensured that the rights & interests of the token holders are protected & they are paid their full dues.

With the above broad understanding of the requirements, let us now dive deep into the steps under Tokenization process.

Steps in Tokenization Process

Step 1 - Asset Selection for Tokenization

Step 2 - Valuation of Asset

Step 3 - Custodian Selection

Step 4 - Token Creation

Step 5 - Token Issuance

Step 6 - Trading & Exchange of Tokens

Step 7 - Redemption of Tokens