Recap

Last week, we introduced tokenization with the analogy of a share certificate to denote ownership in a company. We defined tokenization as :

Tokenization refers to the process of :

Constructing a digital representation (crypto tokens)

for non-crypto assets (also known as "Reference Assets")

on a Blockchain

Just like a share certificate (physically or digitally) proves legally enforceable ownership of the underlying shares, tokens would allow a token holder legally enforceable ownership of the underlying reference asset.

We then elaborated on financial transactions & defined transaction dates / settlement dates and the difference between the two & how that impacts the process of settling financial transactions.

The process of Tokenization has the below requirements:

A Blockchain - the infrastructure in which the tokens are stored

A Reference Asset - A mechanism to derive & assess the value of such an asset

Means to provide custody for the Reference Asset

Redemption & settlement of the Token & Reference Asset

We can trace the concept of tokenization from securitization. What is securitization?

Before we explore tokenization, let us understand securitization & the underlying process behind it:

Securitization simplified

Imagine A owns a set of rental houses & gets rental income from those properties every month.

Photo by Tierra Mallorca on Unsplash

The cash flow from rental income is good enough for monthly expenses. Now, imagine A needs extra money to purchase new properties to expand their Real Estate portfolio. A can go to a bank for a loan, but assuming A doesn't want to do that, what is the other option? They can explore a process called "securitization".

Without getting too much into the process, A can take a portion of their Real Estate Portfolio, combine them & issue a debt security with the Real Estate assets as underlying which can be sold to external investors. These investors will be paid interest & principal from this debt security periodically depending on the issue terms & conditions.

The periodic interest & principal repayments comes from the underlying rental income which is then distributed to all the investors.

So, the Real estate owner A gets access to funds to expand their business & the external investors get access to a new income generating asset who are paid in line with the terms & conditions of the securitization.

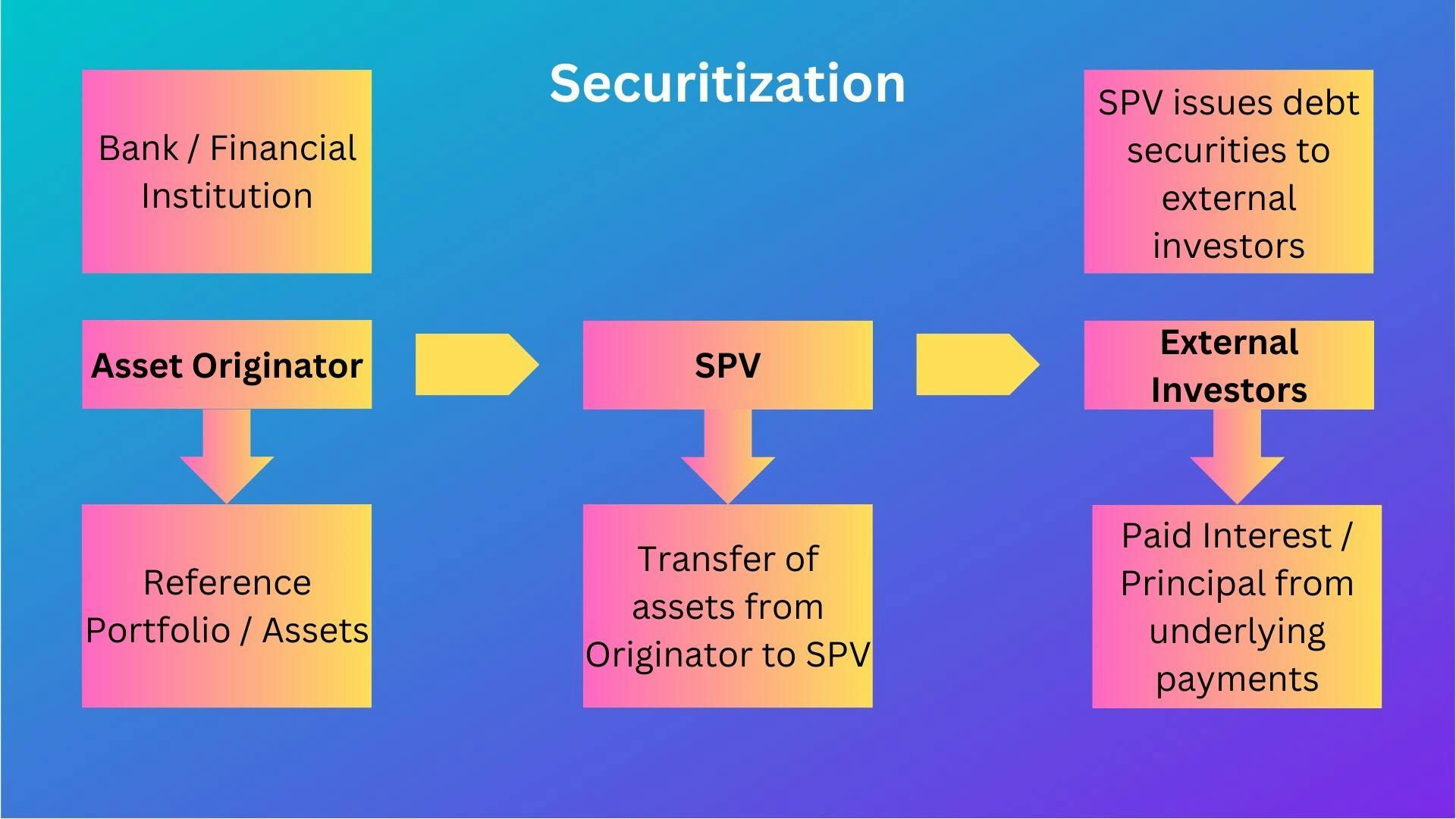

Visualizing the above to make it more simpler:

Securitization Process

With the above understanding, let us now describe the actual securitization process:

Step 1 - A Bank with loans or other income generating assets in it's books (The Originator) identifies the assets it wants to remove from its balance sheet and pools them into what is called the reference portfolio.

Step 2 - It then sells this asset pool to an issuer called a Special Purpose Vehicle or SPV which is an entity set up specifically to purchase the assets.

Step 3 - The issuer finances the acquisition of these pooled assets by issuing tradable, interest-bearing securities that are sold to external investors. The investors receive periodic payments funded by the cash flows generated by the reference portfolio.

In most cases, the originator services the loans in the portfolio, collects payments from the original borrowers, and passes them over directly to the SPV less some amount for fees.

Why would a bank want to securitize it's loan or income generating assets ? That is because

Securitization represents an alternative and diversified source of finance when it wants extra money &

It enables the transfer of credit risk - which is the risk of the borrower defaulting (and possibly also interest rate and currency risk) from issuers to investors.

The below visualization makes is simple :

With the above understanding, let us dive deep into the process of tokenization next week.