Recap

In Week 65 we explored various token classifications based on

Fungibility

Transferability &

Token Flow

Based on Fungibility, tokens are classified into

Fungible &

Non-Fungible Tokens

The difference between Fungible & Non-Fungible tokens is that Fungible tokens are identical and similar in nature & functionality while Non-Fungible tokens are unique & not similar to any other type of non-fungible tokens.

Based on Transferability, tokens are classified into

Transferable &

Non - Transferable tokens

Non - transferable tokens are also called Soulbound tokens.

Based on Token flow, tokens are classified into

Linear tokens &

Circular tokens

Tokens that are created for a single purpose & destroyed when that purpose has been fulfilled are called Linear Tokens

Tokens that can be exchanged back & forth indefinitely without any expiration date are called Circular Tokens.

We said last week that we would explore Non-fungible Tokens this week. However, I felt that we need to explore Tokenization first before exploring different types of tokens.

Tokenization

What is Tokenization? Before we explore tokenization, let us take a simple real-life analogy of share ownership.

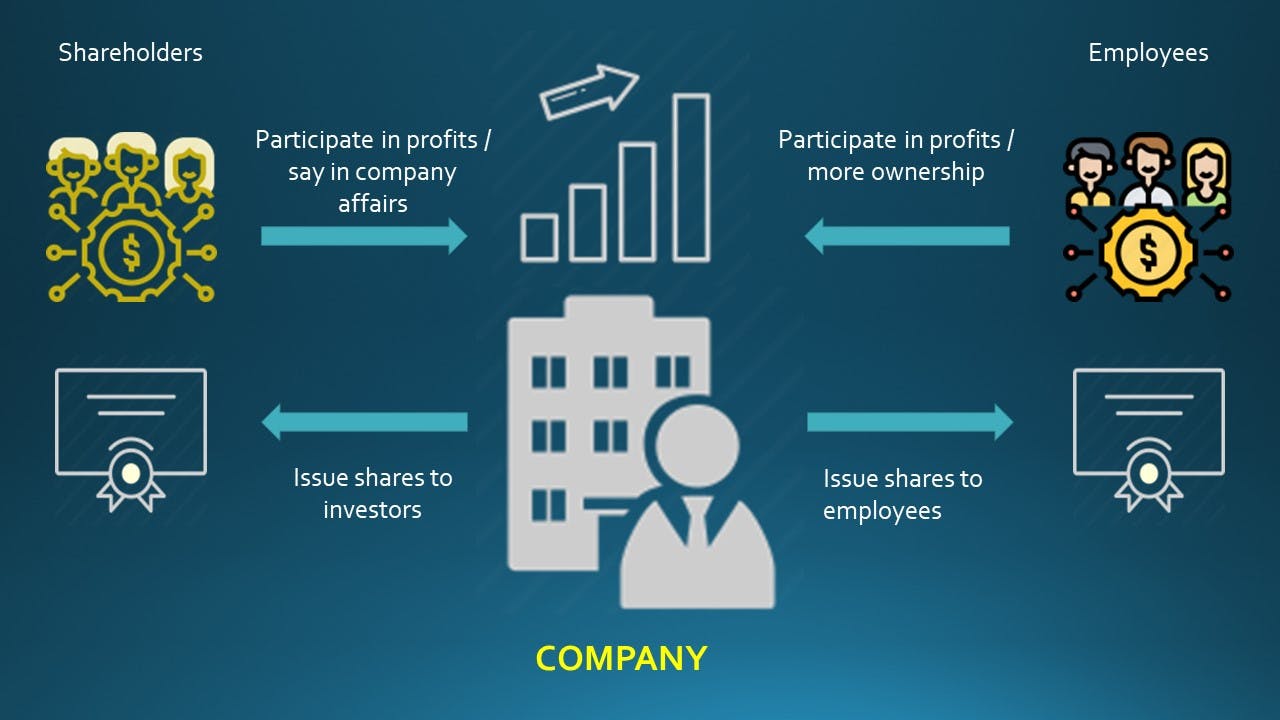

Let us recap the below visualization from Week 63. Companies issue shares to access capital for their growth & people who buy shares (called shareholders) are part owners of the company entitled to share of profits & have a say in company affairs (depending on the number of shares held by them).

Share Certificate

Imagine you have invested in shares of Apple. How would you know that your money has been invested in Apple shares? Simple - you are given a share certificate. What are share certificates?

A share certificate is a written document signed on behalf of a corporation that serves as legal proof of ownership of the number of shares indicated. (Source: here)

It means that the shares you have invested in either for regular returns (dividends or interest) or capital appreciation are represented by a piece of paper called a share certificate.

These share certificates state the number of shares referenced by the certificate. Each certificate has a unique reference number so that only one certificate references the shares under that certificate & the same shares cannot be referenced by another certificate.

If the owner of those shares wants to sell his/her shares to another person, the shares are transferred to the new owner & a new share certificate is issued in the name of the new owner.

Nowadays, physical share certificates are issued only rarely with such records maintained digitally. These digital records are now maintained by registered depository corporations or brokers. Any transfer of shares is recorded by these entities electronically.

Tokenization Definition

How is this relevant to tokenization? Let us first see what is tokenization.

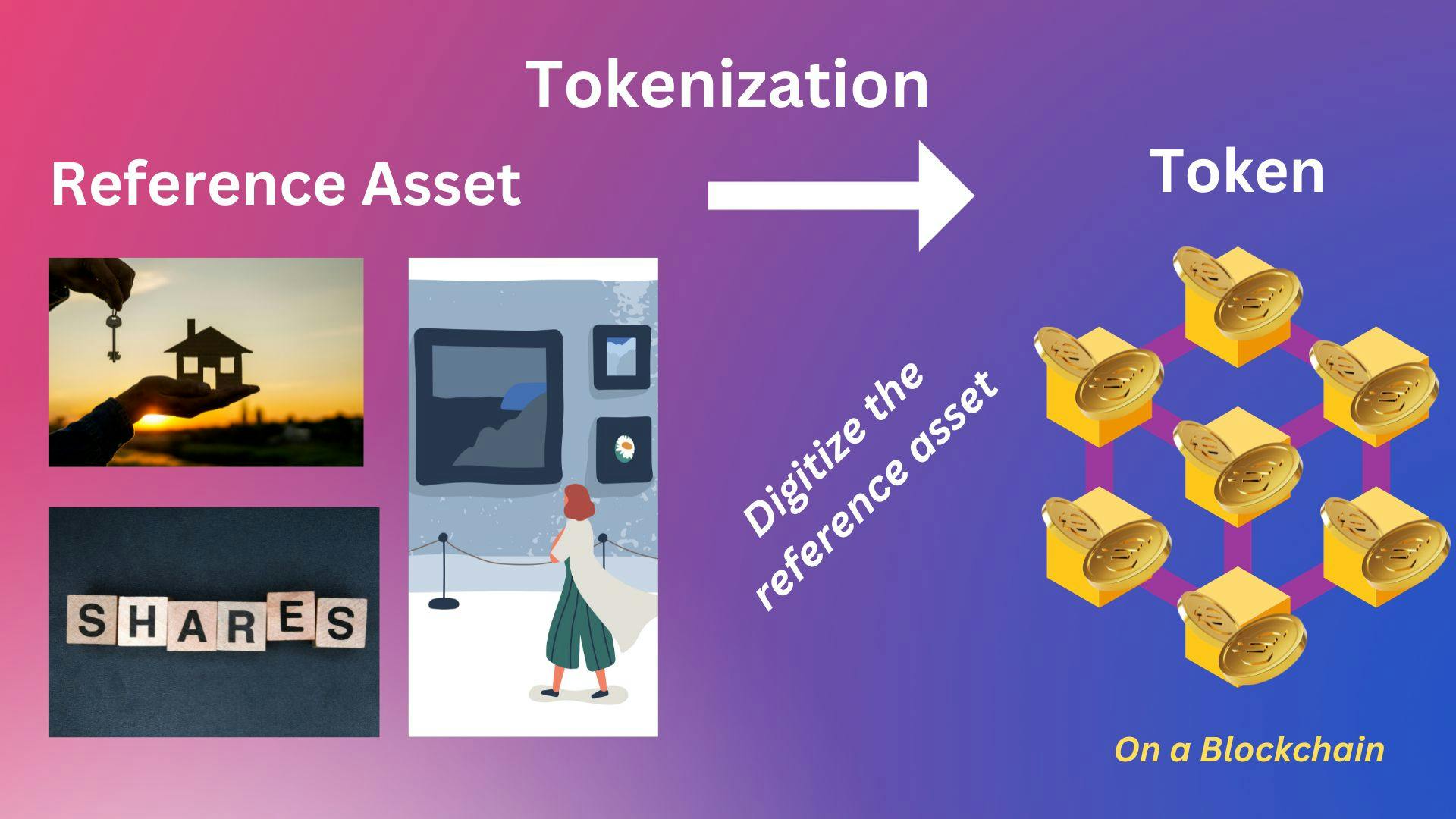

Tokenization refers to the process of constructing digital representation (crypto tokens) for non-crypto assets (reference assets). (Source: here)

So, there is a reference asset which can be shares, real estate, art etc the value or ownership of which can be digitized into a token which can then be stored or traded independent of the reference asset.

Now, the next question is .. where is this token issued? Of course, on a Blockchain. So we expand our above definition to

Tokenization refers to the process of constructing digital representation (Crypto tokens) for non-crypto assets (Reference assets) on a Blockchain.

Just like a share certificate (physically or digitally) proves legally enforceable ownership of the underlying shares, tokens would allow a token holder legally enforceable ownership of the underlying reference asset.

Tokenization can tokenize different types of assets (like real estate, art, shares, money etc) & can create different types of tokens (stablecoins, fungible tokens, non-fungible tokens etc) depending on the reference asset.

The below visual makes it more clear:

We discussed digital share certificates above. Each day there could be share trades amounting to millions of dollars. There is a huge back office process of issuing trades, maintaining records, settlements of trades etc. Why?

There are two parts to any financial transaction :

Transaction date - Date when the actual trade occurs (Buying / Selling of shares)

Settlement date - The date when actual ownership of the shares is transferred

The settlement dates & the trade dates are normally never the same. There is always a difference of one, two, three or five days (depending on the type of transaction) between the two. E.g.,

If the shares are bought or sold on 1st January, the funds move on the same date, but the ownership of those shares are transferred on 6th January. This means

Transaction Date = 1st January

Settlement Date = 6th January

The above is what is known as T+5 which means the settlement occurs on transaction date plus five days. Similarly, there can be T + 2 (Transaction date plus two days) or T + 3 (Transaction date plus three days) etc.

Trading transactions & related funds settlements take place on different days, across countries, various time zones etc. Hence, there is a huge back office cost involved in carrying out, maintaining & reconciling financial transactions. We only took the example of share trades. This is applicable to any financial transaction (e.g., Bonds, T-bills, Government securities, money market, interbank deals etc).

Tokenization Features

Below are the important aspects to be considered in Tokenization :

A Blockchain - the infrastructure in which the tokens are stored.

A Reference Asset - A mechanism to assess & derive the value of such an asset

Means to provide custody for the Reference Asset

Redemption & settlement of the Token & Reference Asset

Let us explore each of the above next week.