Recap

Last week we defined a token as something that provides the right to a service(s) or asset(s) for a certain value.

We started with physical tokens which generally have value in the ecosystem(s) where they are issued e.g., casinos. The underlying infrastructure where tokens are issued & given validity is called a substrate. The substrate is what gives validity to a token.

We also saw that the value of a token represents equivalent cash that can be exchanged for that token.

We then moved to crypto tokens where tokens can represent a right to an underlying asset with some economic value. Tokens in a Blockchain are entries in a ledger which is mapped to the address of a token holder.

We then defined Crypto Economics as a subject that brings together the field of economics & computer science to study the decentralized marketplace & applications that can be built by combining cryptography with economic incentives.

We then ended with protocols that are developed to ensure effective governance over applications & the Blockchain infrastructure. akin to monetary & fiscal policies to manage economies.

This week we will recap what we discussed in Weeks 53 & 54 to provide continuity to our discussion & then move forward.

Why Tokens?

What is the end objective when issuing or buying tokens? At a very high level, there are three aspects to be considered. These are :

As Incentive

For Ownership

As Currency

Let us explore each of the above & we will revisit them in the coming weeks.

As Incentive

The actors or agents in an ecosystem are directed or motivated to act in a particular way or ways through rewards for the betterment of the ecosystem. These rewards are known as incentives.

Incentives are thus used to motivate or direct the actions of relevant players to contribute to the ecosystem they are involved in. E.g., salaries & other monetary compensation paid to employees serve as incentives to contribute to the company's operations & results.

In Blockchains, tokens are used as below :

Miners (assuming Proof-of-Work Blockchain) or Validators (assuming Proof-of-Stake Blockchain) are rewarded with tokens at the time of block creation.

Tokens are used to pay transaction fees to miners for validating transactions. Higher transaction fees mean quicker validation. Here, tokens are Bitcoin in the Bitcoin Blockchain or Ether in the Ethereum Blockchain.

Here, tokens are used as incentives to motivate miners to maintain the network to ensure they do the tasks required of them.

For Ownership

Let us consider a start-up. When a company is created, it needs money for its day-to-day operations & to grow its business. It needs to invest in assets (e.g., machinery) or pay expenses. Where does this money come from?

It can be from :

a. Owners by financing the company themselves (bootstrapping) or

b. The outside world where owners seek external parties to invest in the company

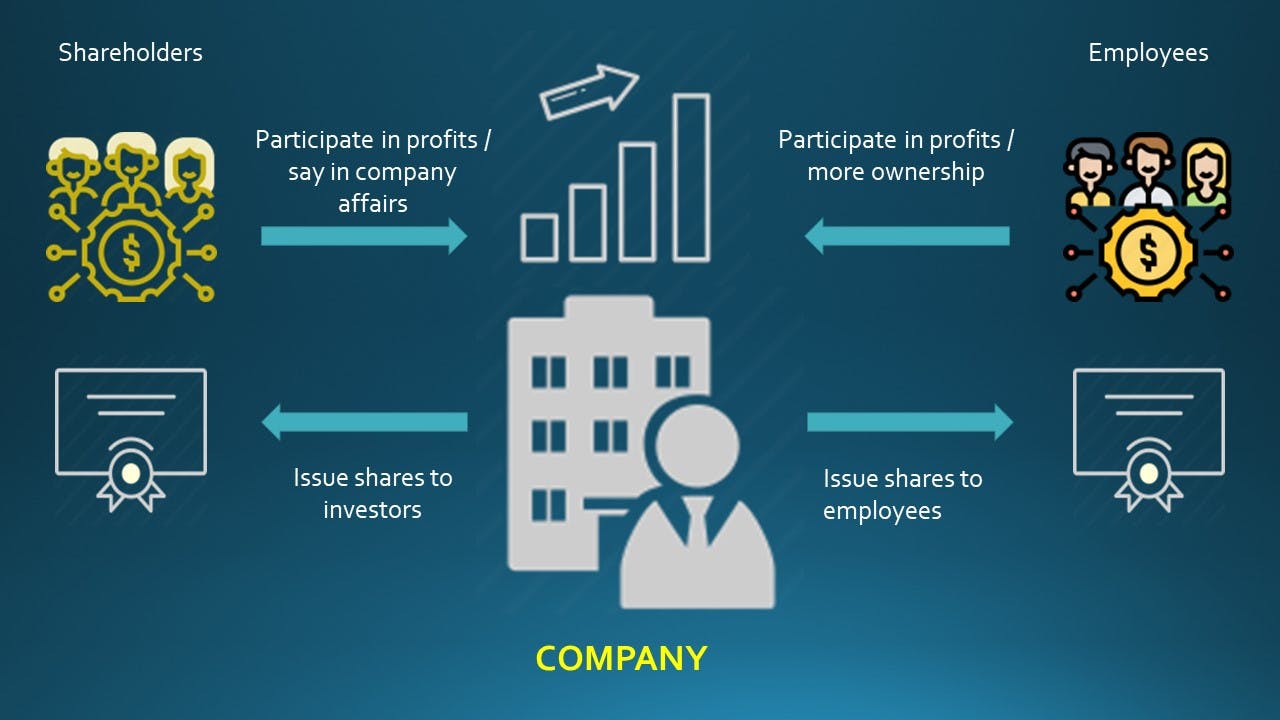

If they ask the outside world, one of the ways companies access funds is by issuing shares to investors who take a stake in these companies.

These investors then participate in the company's performance through share of profits which means investors are eligible for a share in profits made by the company in proportion to the number of shares held motivating them to stay invested in the company.

Investors are also rewarded through capital appreciation of their shares which means better performance of companies generally results in higher share prices. (Other market factors may cause prices to fluctuate but we will ignore them for now).

Without getting too technical, shares are generally tradeable through exchanges. An individual share is a unit of value (e.g., one share can have a value of $1, $10, $100 etc.). Each unit can be traded through exchanges.

Let us represent the above ecosystem visually for better understanding :

This ownership also gives them a say in the activities of the company to the extent of shares held. So, shares facilitate interaction between the company & shareholders/investors.

We will get into tokens as funding sources for any project or initiative in the coming weeks.

As Currency

Photo by Pixabay: https://www.pexels.com/photo/rolled-20-u-s-dollar-bill-164527/

We need to first understand that paper money or coins are also tokens. Why? Because they provide access to economic resources or services. We have to pay money to buy something or get some service. Money can also represent assets or investments.

Where does the money come from? Money is issued by the Central Bank of a country. The amount of money in circulation (also known as M1 & M2) is determined based on various economic parameters & controlled by Central Bankers. Monetary policy is a set of tools used by Central Bankers to control the supply of money in an economy. Comparing tokens with money,

A token should be issued by an entity like "private money". Money is issued by Central Banks

It should have a platform where it "resides" or can be carried on. In the case of money, it is the economic & monetary system where the currency is issued.

It should be meaningful for the platform or use case. Currency issued by a Central Bank is valid in the country of issue or other countries as a medium of exchange.

It should have some value. Money is used as a store of value.

There should be some asset or service that can be bought or sold with this token. We can buy or sell any asset or service in return for money (as a unit of account which in turn ties with its use as a store of value and medium of exchange).

We discussed above on miners being rewarded using tokens for creating blocks & validating transactions. The usage of tokens as payments for block creation or transaction fees is like using a currency in that ecosystem where payment is done through the underlying platform token (e.g., pay in Bitcoin or Ether).

A Blockchain platform has protocols governing token issuance just like Governments have monetary & fiscal policies governing currency issuance depending on economic factors. The algorithms behind those protocols determine the rate of issuance of these tokens. We will get into the economics of these algorithms later. For e.g.,

In Bitcoin Blockchain, the monetary policy is as below:

Every day, transactions are initiated & approved in the Bitcoin Blockchain. The number of nodes & validators keeps changing daily as the entire platform is decentralized & open to anyone. So new nodes can join anytime or existing nodes can leave. To ensure consistency in the issuance of Bitcoin, the algorithm adjusts the difficulty of solving the Proof-Of-Work problem in a way that it increases depending on how quickly valid blocks are created (more new miner nodes). The difficulty decreases accordingly when the rate of creation of new blocks decreases (fewer miner nodes). Thus, there is a daily constraint in Bitcoin issuance.

After the creation of every 210,000 blocks, the block reward drops by half. In other words, the rewards for mining Bitcoin are halved every 4 years thus decreasing the issuance algorithmically & through the difficulty adjustment ensuring consistency in decrease irrespective of the number of miners or blocks created. In the beginning, miners used to get 50 Bitcoins per block.

The total number of Bitcoins which will be issued is 21 million by the year 2140.

Token Classification

Tokens can be classified based on multiple criteria. We will focus on some major ones:

Source

Classification based on the source system where the token is issued :

Protocol Tokens &

Application Tokens

Usage

Classification based on token usage :

Utility Tokens &

Equity Tokens

Fungibility

Classification based on token fungibility

Fungible Tokens &

Non-Fungible Tokens

Transferability

Classification based on transferability of tokens :

Transferable

Non-transferable

We will explore the above in detail next week.