Recap

Last week we discussed Optimistic Roll-ups, which is a layer 2 solution where

They move computation & storage away from the main Blockchain by

Accumulating transactions into a single batch & executing them off-chain i.e., the transactions are processed outside the main Blockchain, summarized and then added to the main Blockchain.

Unlike ZK-Rollups, off-chain transactions in Optimistic Roll-ups are assumed to be valid & there is no publishing of proof-of-validity for transactions on-chain.

We also discussed fraud proof.

Let us now rewind to Weeks 51 to 52 where we started our discussion on tokens to refresh our memories.

Tokens

Photo by Aidan Howe: https://www.pexels.com/photo/dice-and-casino-tokens-4677404/

What exactly are tokens?

Definition

As per Merriam-Webster, a token is defined as (among others):

A piece resembling a coin issued for use (as for fare on a bus)

A piece resembling a coin issued as money by some person or body other than a de-jure government

something given or shown as a guarantee (as of authority, right or identity).

E.g., tokens issued at entertainment venues give the right to play all or certain games or tokens issued at night clubs (or self-inking hand stamps) give the right of access to patrons of the club.

Thus, tokens provide the right to a service(s) or asset(s) for a certain value.

Token Types

For ease of understanding, let us divide tokens into Physical which are real-life tokens & Crypto which are Blockchain-based.

Physical Tokens

Physical tokens provide the right to a service(s) or asset(s) for a certain value. For example,

In a casino, a customer can use tokens to play games where he/she has to first pay cash for these tokens. Once he/she completes their wins, they have to exchange their tokens for cash before they leave the casino.

Substrate

These tokens don't have any value outside the casino & can only be used inside the casino. That means these tokens are only valid in the underlying infrastructure of the casino. This underlying infrastructure where tokens are issued & is given validity is called a substrate. The substrate gives validity to a token where it is used.

Another example of substrate is a cinema where tickets are issued & can be used only in that particular cinema & for a particular show.

Photo by Tima Miroshnichenko: https://www.pexels.com/photo/an-empty-cinema-7991486/

Token Value

In almost all cases, tokens are issued against cash. In this case, the value of the tokens represent equivalent cash that can be exchanged for those tokens.

Tokens are unique in that they cannot be duplicated. They have unique identifiers, e.g., serial no. or color denoting their value. Thus, there are rules associated with tokens on their issuance.

Can you think of a token that we use daily & is used by everyone? Currency notes & coins. Notes & coins issued by Central Banks are also tokens. The substrate where these tokens are valid is the economy of the country where these notes & coins are issued & used.

Crypto Tokens

Let us now move from the physical world to the world of Crypto. To understand tokens in crypto, let us frame our discussion around the below questions :

What are tokens in the context of Blockchain?

Why do we need tokens in a Blockchain?

Tokens in Blockchain

Tokens in a Blockchain are nothing but an entry in the ledger which is mapped to the address of the token holder. Only the wallet that has the private key of that address can access the tokens. Thus, the owner of that wallet is the owner or custodian of those tokens.

The below visualization makes it clear:

Now, these tokens have rules which give the owner access to some services or rights in the Blockchain or application. These rules are encoded in a smart contract. These smart contracts representing tokens are called token contracts.

In simple terms, tokens can be issued with a few lines of code & deployed on the Blockchain.

Token Requirement

In crypto, a token can represent a right to an underlying asset with some economic value. These assets can be physical or digital & the rights can be long-term or short-term. The rights can be classified under:

Property Rights

Access Rights or

Voting Rights

We know that assets with a value in the true sense (assets that cannot be duplicated like files or images) can be recorded on a Blockchain.

Recording this value & representing this value through tokens means tokens can represent anything from a store of value to a set of permissions in the physical or digital world in a unique sense.

Also, issuing these tokens with rights at low cost & minimum effort in a Blockchain makes it economically feasible to represent different types of assets digitally which may not have been possible before.

Token Economics

Before getting into Token economics, let us understand Economics first.

Economics

What is Economics?

Image by Peggy und Marco Lachmann-Anke from Pixabay

As per Wikipedia,

Economics is defined as a social science that studies the production, distribution & consumption of goods & services.

Economics focuses on the interactions between economic agents & how economies work.

There are two branches of Economics study - Microeconomics & Macroeconomics

Microeconomics analyzes particular markets & segments of the economy. It explores consumer behavior, labor markets & firms.

Macroeconomics analyzes the economy as a whole. It looks at total or aggregate variables which impacts an economy as a whole like aggregate demand, aggregate supply, inflation etc.

In any economy,

There are actions involved, viz., production, distribution, consumption etc.

There are outputs - goods & services

There are agents or actors involved - markets, households, buyers, firms etc

The interaction of all the above creates an economic ecosystem of a country

The actors in a country's economic system are incentivized to interact with the ecosystem in certain ways depending on the economic environment. For example, in an inflationary environment, Central Banks raise interest rates to reduce inflation causing people to behave a certain way or lower interest rates in a recession causing people to behave in another way.

Similarly, a Blockchain can be considered as an ecosystem where there are economic interactions between users, miners, developers & other stakeholders in a Blockchain ecosystem. There are incentives to maintain & keep the infrastructure working & for the actors involved in that ecosystem to behave in certain ways. These incentives are implemented through tokens.

Trust Factor

Centralized entities like Finance Ministry or Central Banks are entrusted with the responsibility to run a country's economy. However, in a crypto ecosystem, none of the actors know each other & in the Blockchain ecosystem, the algorithms coupled with cryptography take care of that "Trust".

Next, let us understand what is crypto-economics.

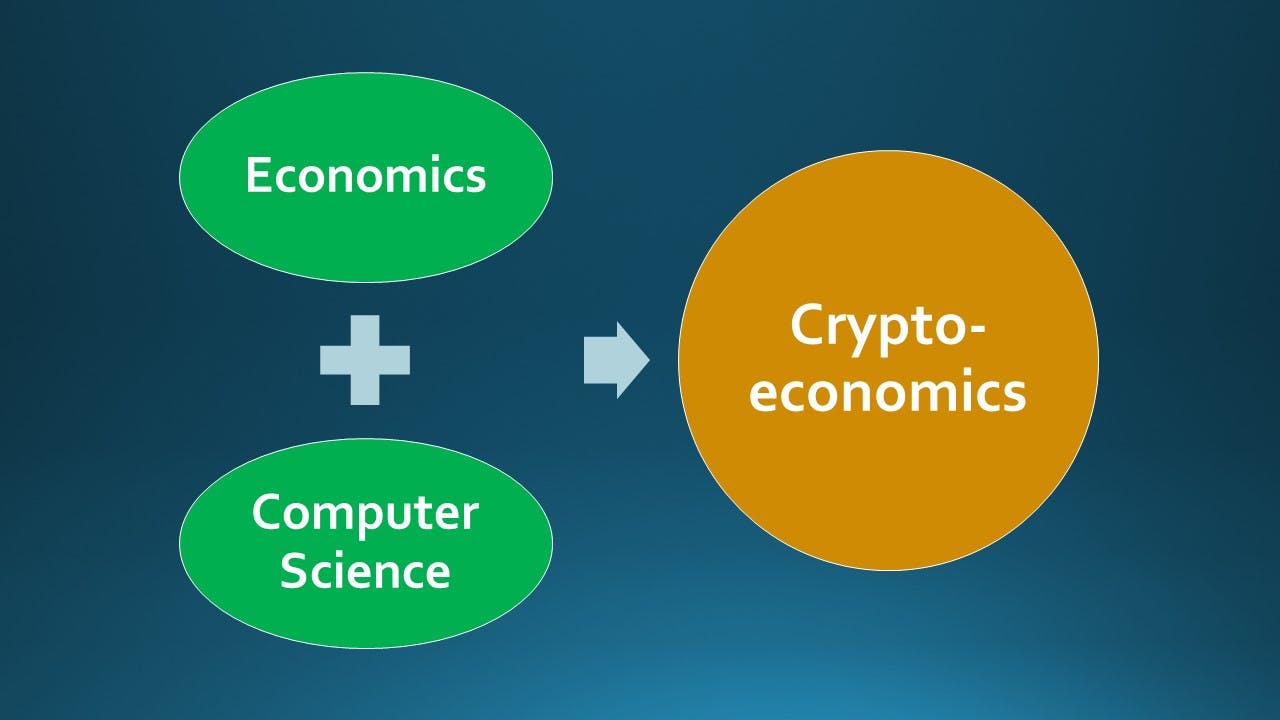

Crypto-Economics

As per MIT Cryptoeconomics lab,

Cryptoeconomics brings together the field of economics & computer science to study the decentralized marketplace & applications that can be built by combining cryptography with economic incentives.

Protocols

Just like Governments & Central Banks have monetary & fiscal policies to manage the economy of a country, in a Blockchain, protocols are developed to ensure effective governance over applications & the Blockchain infrastructure. These protocols define how the stakeholders & participants in a Blockchain network interact with each other. Protocols also govern the issue & management of tokens through smart contracts.

The first & most popular use-case of tokens is digital currencies like Bitcoin or Ether. These tokens are issued to miner nodes to compensate them for CPU & power usage to support the infrastructure. These act as incentives. However, this is not the only use case of tokens.