Table of contents

Image by Erdenebayar Bayansan from Pixabay

Recap

Last week we started with Economics as below:

Economics is defined as a social science that studies the production, distribution & consumption of goods & services & it focuses on the interactions between economic agents & how economies work. (Source: Wikipedia)

The crypto world, using the above analogy, is an ecosystem consisting of:

Outputs - transaction blocks, decentralized applications

Agents or actors involved - application developers, users, infrastructure developers, nodes etc

All the above stakeholders interact to create a decentralized ecosystem.

We then introduced protocols as monetary & fiscal policies to ensure effective governance over applications & the underlying Blockchain infrastructure. These protocols define how the stakeholders & participants in a Blockchain network interact with each other.

The actors or agents in an ecosystem are directed or motivated to act in a particular way or ways. These are done through rewards for the betterment of the ecosystem. These rewards are known as incentives.

Incentives

Incentives are used to motivate or direct the activities of relevant players to contribute to the ecosystem they are involved in. For example, salaries & similar incentives are paid to employees to motivate them to contribute to the company's operations & results. There are multiple ways of incentive payments:

In Cash (like Salaries, Bonus etc.,) or

In-Kind where employees are provided shares of the company (popularly known as ESOP or Employee Share Option Plan).

The shares issued in such cases motivate employees by giving them ownership rights & incentives connected to those shares like capital appreciation or dividends.

Now, let us understand - What is a share?

Ownership

Whenever a company is created, it needs money to operate on a day-to-day basis & to grow its operations. It needs to invest in relevant assets (e.g., machinery) or pay expenses (e.g., salaries, rent etc). Where does it get this money from?

It can be from owners from their finances (bootstrapping) or the company will ask the outside world for funds. If they ask the outside world, one of the ways companies access funds is by issuing shares to those investors who take a stake in these companies.

These investors then participate in its performance through a share of profits which means investors are eligible for a share in profits made by the company in proportion to the number of shares held.

Investors are also rewarded through capital appreciation of their shares which means better performance of companies generally results in higher share prices. (Other market factors may cause prices to fluctuate but we will ignore them for now).

Without getting too technical, shares are generally tradeable through exchanges. An individual share is a unit of value (e.g., one share can have a value of $1, $10, $100 etc). Each unit can be traded through exchanges.

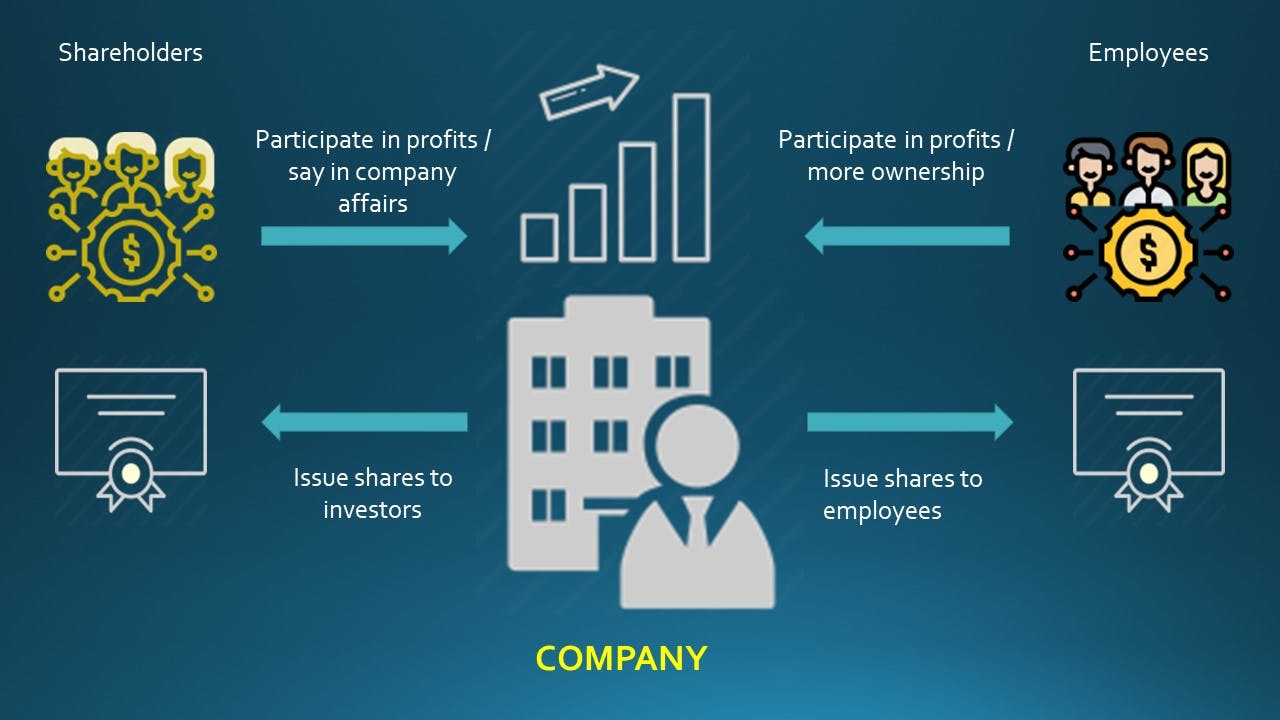

Let us represent the above ecosystem visually for better understanding :

This ownership also gives them a say in the activities of the company to the extent of shares held. So, shares facilitate interaction between the company & shareholders/investors.

With the above understanding of shares, let us move to the crypto world & start with the familiar examples of Bitcoin & Ethereum Blockchains. In Blockchains, tokens are used as below :

Miners (assuming Proof-of-Work Blockchain) or Validators (assuming Proof-of-Stake Blockchain) are rewarded with tokens at the time of block creation.

Tokens are used to pay transaction fees to miners for validating transactions. Higher transaction fees mean quicker validation. Here, tokens are Bitcoin in the Bitcoin Blockchain or Ether in Ethereum Blockchain.

Tokens as Currencies

From the above usage of tokens as payments for block creation or transaction fees, it behaves like a currency in that ecosystem where payment is done through the underlying platform token (e.g., pay in Bitcoin or Ether).

A Blockchain platform has protocols governing token issuance just like Governments have monetary & fiscal policies governing currency issuance depending on economic factors. The algorithms behind those protocols determine the rate of issuance of these tokens. We will get into the economics of these issuances later.

E.g., In Bitcoin Blockchain, the monetary policy is as below:

Every day, transactions are initiated & approved in the Bitcoin Blockchain. The number of nodes & validators keeps changing daily as the entire platform is decentralized & open to anyone. So new nodes can join anytime or existing nodes can leave. To ensure consistency in the issuance of Bitcoin, the algorithm adjusts the difficulty of solving the Proof-Of-Work problem in a way that it increases depending on how quickly valid blocks are created (more new miner nodes). The difficulty decreases accordingly when the rate of creation of new blocks decreases (fewer miner nodes). Thus, there is a daily constraint in Bitcoin issuance.

After the creation of every 210,000 blocks, the block reward drops by half. In other words, the rewards for mining Bitcoin are halved every 4 years thus decreasing the issuance algorithmically & through the difficulty adjustment ensuring consistency in decrease irrespective of the number of miners or blocks created. In the beginning, miners used to get 50 Bitcoins per block.

The total number of Bitcoins which will be issued is 21 million by the year 2140.

Ethereum Blockchain has a different monetary policy. It is interesting to note that something which used to be done by Governments is now a part of a new paradigm & ecosystem.

We will dive deep into the token ecosystem and explore more concepts in the coming weeks.

Image by Andrew Martin from Pixabay