To recap, last week we defined

- Cryptocurrency - a medium of exchange which is digital, encrypted using cryptography and decentralized

- Encryption - converting plaintext to ciphertext

- Decryption - converting ciphertext to plaintext

We introduced the concept of decentralization and how it all started - the whitepaper by Satoshi Nakamoto. Before we get into Satoshi's whitepaper, let us understand

What problem did Satoshi Nakamoto try to resolve? Why do we need a digital currency?

Was bitcoin the first attempt to create a digital currency?

To address the above, we need to understand the concept of transfer of value. In the physical realm, value is transferred :

a) When Person A pays cash to Person B. The ownership & value of cash transferred moves from Person A to Person B

b) When an asset is legally transferred from Person A to Person B in exchange for another asset of equivalent value or cash. The asset can be anything of value - from perishable goods like fish , commodities like gold, silver or immovable assets like land or building

Now, in the physical realm there are certain underlying aspects we take for granted when we transfer assets which are:

1. The same asset cannot be transferred more than once.

Meaning, you cannot transfer the same asset twice. How is this achieved? By creating unique identifiers for the asset. E.g., each currency note has a serial number at the time of it's issue. This serial number is unique to that note. These serial numbers are recorded & controlled at the Central Bank where a track is kept of the fiat currency notes issued. Similarly, Land has a unique survey number, shares have unique certificate numbers etc. Hence, if we try to sell the same asset subsequently, it can be tracked by these unique identifiers.

Do we have any such control or unique identifiers for digital transfer of asset or value? In the current scenario, No.

We know how to send files or photos over the internet. We can send multiple copies of the same file to different recipients. To transfer value digitally, it has to be ensured that the digital asset cannot be transferred more than once or in the case of a digital currency, cannot be spent more than once. This problem of spending the same digital currency twice is called Double-spending. More on double spending here

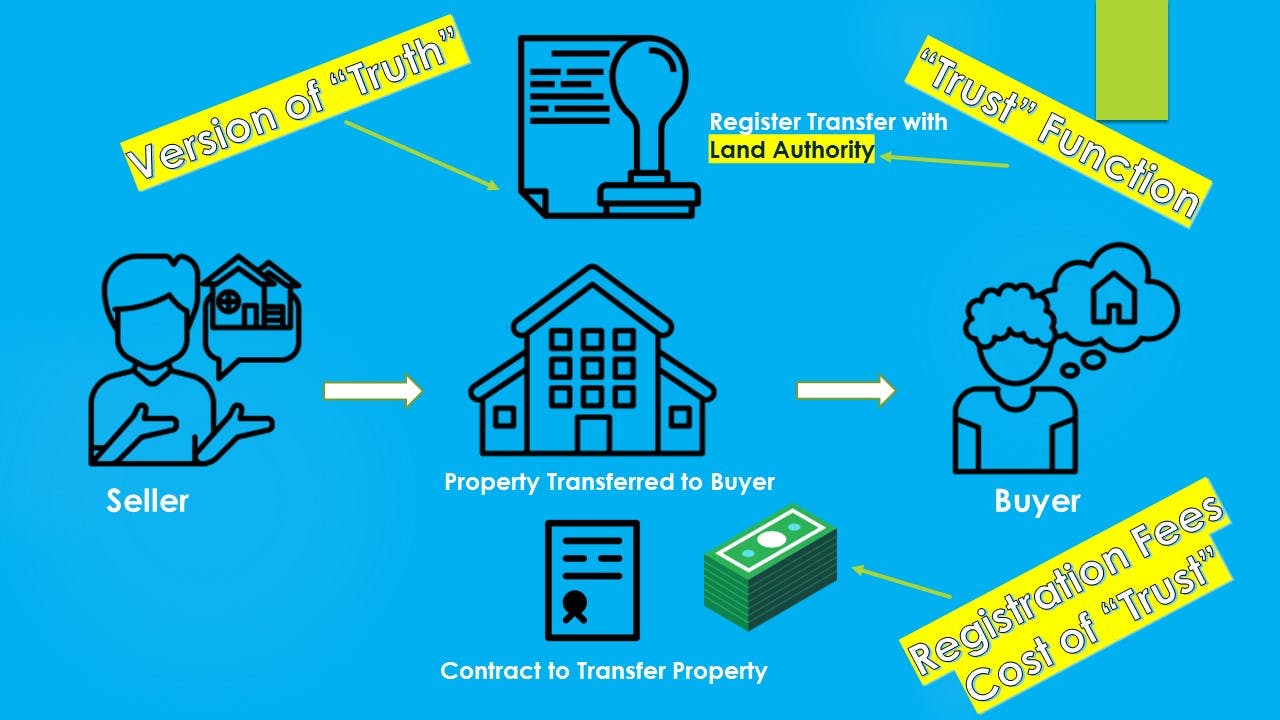

2. There is a Central Authority involved when a transfer of an asset takes place. E.g.,

In the case of share transfers, the transfer of ownership must be registered with a registrar or depository

In the case of land transfer, the transfer needs to be registered with the land authority.

In the case of funds transfer, the banks verify the authenticity of source, recipient and validity of the transaction.

For cash, there is no authority involved per-se when the cash moves hands. However, the serial number of the note is recorded in the Central Bank ledger as an entry on issuance of the note.

All the above authorities or intermediaries are required to verify the authenticity of ownership of an asset or validity of a transaction. That means, they are required to create TRUST and the records maintained by them is considered as the "TRUTH" and is relied upon to prove authenticity of ownership or validity.

Just like moving value in the physical realm, there were attempts to move value digitally through the internet. Why?

A. High cost of transferring value.

To repeat from an earlier example, for a bank transfer, the banks check whether

a) The sender actually has the funds to initiate the transfer

b) The sender is actually who he claims he / she is

c) The funds actually move to the recipient's account

The above services for creating "trust" add to the cost of transaction

B. Eliminate Intermediaries for a more efficient & seamless transfer of value

Hence, there were attempts to create a digital currency to eliminate intermediaries and "automate" the function of creating "trust". In other words

TO MOVE VALUE PEER-TO-PEER WITHOUT A TRUSTED CENTRAL INTERMEDIARY

As per Merriam-Webster, peer to peer is defined as

: relating to, using, or being a network by which computers operated by individuals can share information and resources directly without relying on a dedicated central server In peer-to-peer computing, every client can be a server. You string together two or more computers, and everyone can share files, programs, drives …, printers, and anything else that's attached.

It is important to distinguish this digital transfer of value from online payments. Online payments are movements of fiat currency balances recorded in the ledgers of banks. As I mentioned in one of my earlier blogs, the sender's account is debited (balance is reduced with amount transferred) and the receiver's account is credited (balance increases with amount received) in their respective bank ledgers.

Much before bitcoin, there were attempts to move value through the internet without any intermediary or authority and anonymously. The earliest attempts to create a digital currency started in the early 80s. However, all of them failed due to

a. Centralization - A Central authority such as a bank was required to ensure that funds were not spent twice. They relied on banks and Financial Institutions for the necessary checks and balances.

b. Relying on banks and Financial Institutions created a single point of failure for digital currencies. If the bank failed, the digital currency also went down with it.

c. Due to the anonymous nature of transactions, the risk of being shut down by regulators were high.

The failed attempts at creating digital currencies in the past and by finding solutions to the problems that caused these digital currencies to fail gave rise to many of the ideas and concepts that led to the creation of Bitcoin. As a tribute to these early pioneers - the key players were David Chaum, Nick Szabo, Adam Back, Wei Dai and the original Cypherpunks who played significant roles in bringing this paradigm to life.

Now, let us see how bitcoin succeeded when all earlier models failed in creating and transferring value over the internet by understanding BLOCKCHAIN - the underlying infrastructure.